A Year of Moderate Growth

After several years of sizzling improvements in fundamentals, 2017 was a year of retrenchment in the multifamily market. Rent growth cooled amid robust development, and occupancy levels—although still solid—began to trend down in some metros. The question heading into 2018 is whether the market has passed its peak and is headed for a correction or whether the sector's bull run has more steam left in it. Our view is that there is some growth left—though it will be tepid for the next 18 to 24 months.

On a big-picture basis, demand for multifamily shows no signs of slowing.

The number of Millennials in the prime 20-to-34-year-old renter cohort will keep growing, while retirees will continue to downsize. Forecasts call for household growth of roughly one million per year for the next few years, and although housing is recovering, rental demand will be fueled by urbanization and other social trends such as fewer cars on the road.

Economy:

We expect another year of moderate economic growth, with potential upside from the recently passed tax reform bill that will lower tax rates and encourage corporate investment. It likely will take at least a couple of quarters before the impact is felt, though. Job growth could slow as the labor market nears full employment, but should remain healthy.

Rents:

Rent growth decelerated significantly in 2017, and we expect moderate increases in the 2% range nationally. Growth will be kept in check by the increases in supply, especially in luxury properties, and the lack of affordability in high-cost metros such as New York and the Bay Area.

Demand will remain high in the Sunbelt and growing markets in the West and Southwest.

Supply:

We forecast 360,000 deliveries in 2018, which would mark a peak for the cycle and would be up from roughly 300,000 new units that came online in 2017. We expected more deliveries last year, but the shortage of construction workers slowed down the delivery pipeline by lengthening the construction period. The delays do have an upside, giving owners more time to absorb the heavy pipeline.

Capital Markets:

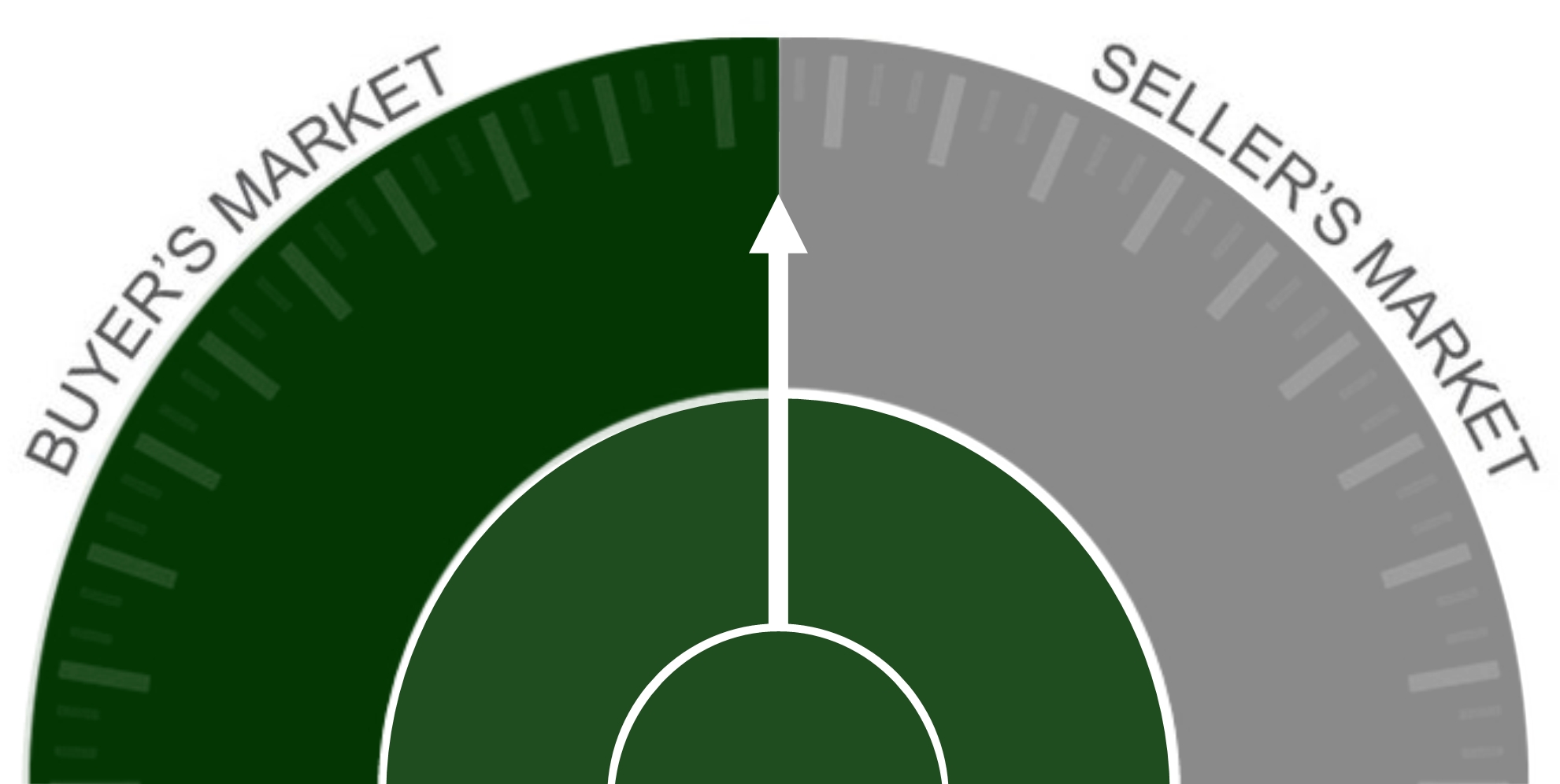

There is some healthy caution being interjected into the equity and debt markets, but capital forces remain robust. Property sales have declined slightly for two straight years as buyers start to question how long the positive fundamentals cycle will last, but there is no shortage of capital for appropriately priced assets. Debt availability remains as strong as ever, led by Fannie Mae and Freddie Mac, which could hit another year of record lending.

more details on the attached report yardi matrix

https://www.giuseppedaghino.com/allegati/2018-winter-national-outlook.pdf